We Provide Cooling Tower Solution

English

Please Choose Your Language

Views: 0 Author: Site Editor Publish Time: 2025-11-13 Origin: Site

As Vietnam’s industrialization accelerates—driven by manufacturing expansion, data center construction, and energy infrastructure—the cooling tower market (Vietnamese: tháp giải nhiệt) has become increasingly diverse. It now features both strong domestic manufacturers and globally recognized brands that have entered through local distributors and EPC contractors.

This article identifies the Top 10 Cooling Tower Manufacturers in Vietnam, ranked by market visibility, production capacity, engineering and service capabilities, and local project references. It aims to help readers—engineers, consultants, and procurement professionals—understand the competitive landscape and make better-informed purchasing decisions.

Alpha Cooling Tower is one of the best-known Vietnamese manufacturers and installers of cooling towers. It provides design, fabrication, and on-site installation services for industrial plants, commercial buildings, and power facilities. Alpha has completed numerous projects across Vietnam and maintains a reliable after-sales service network.

Liang Chi, originally from Taiwan, operates through distributors and assembly facilities in Vietnam. It specializes in FRP (fiberglass reinforced plastic) and modular cooling towers widely used in steel, textile, and process industries. Its modular structure allows fast on-site assembly and replacement.

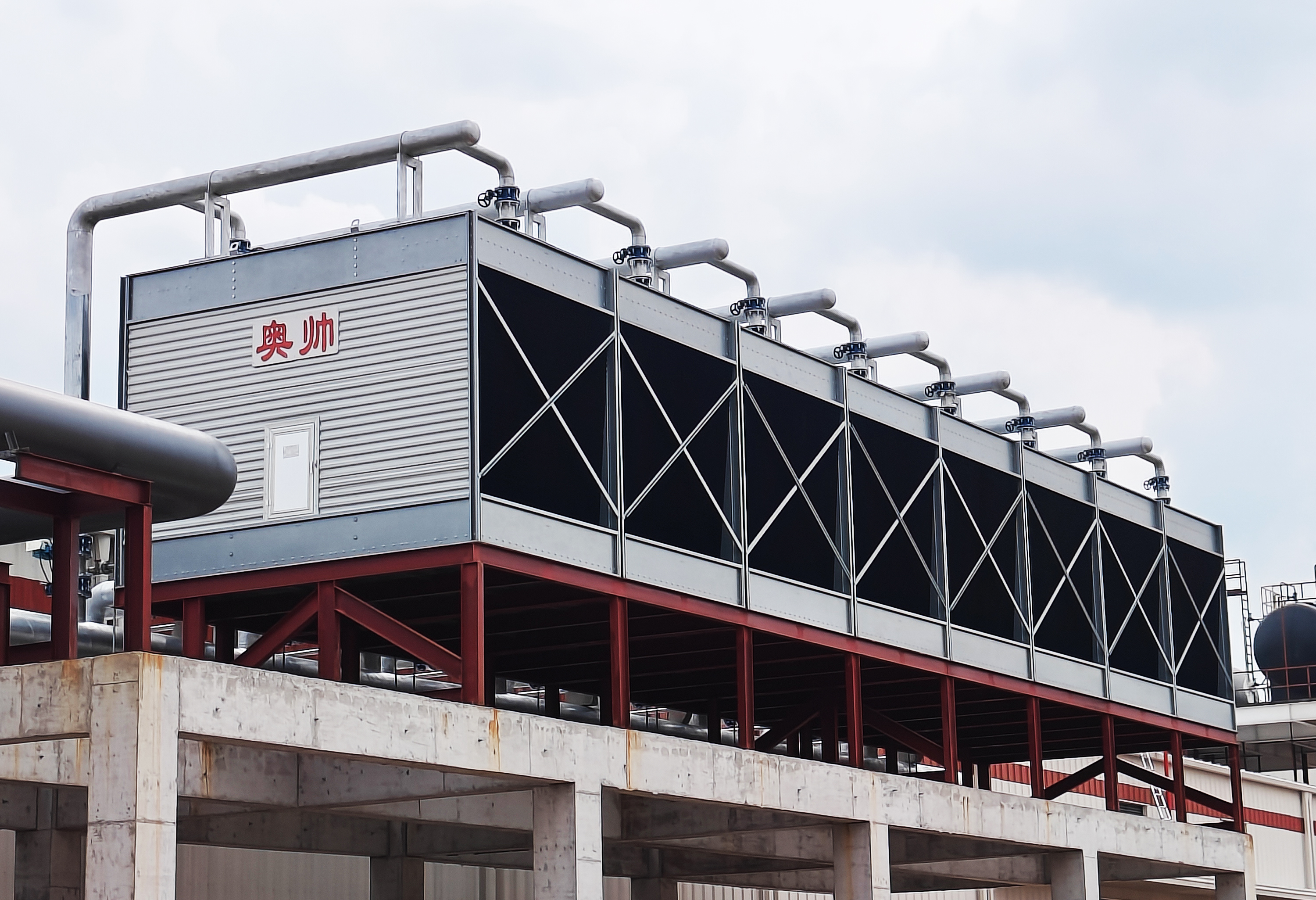

Mach Industry (Zhejiang) Co., Ltd., based in China’s Zhejiang province, has established itself as a reliable supplier of industrial cooling towers, heat exchangers, and related thermal control systems.

The company exports extensively across Southeast Asia, including Vietnam, through authorized partners and EPC contractors.

Mach Industry’s towers emphasize energy efficiency, corrosion resistance, and structural reliability, making them well-suited for manufacturing facilities, electronics cooling, and HVAC applications.

Its growing presence in Vietnam reflects the increasing integration of Chinese precision manufacturing with Vietnam’s rapidly expanding industrial base, offering competitive pricing with strong technical support.

Companies like Protech act as both distributors and engineering contractors. They not only sell finished cooling towers but also offer system design, fill replacement, and repair services, ideal for customers seeking long-term operation and maintenance contracts.

Kumisai and several other Asian brands have entered Vietnam via authorized distributors, supplying cooling towers compatible with chillers and refrigeration systems. These products are particularly popular in HVAC and cold-chain industries.

Brands like Tashin (Taiwan) and Kuken (Korea) maintain distribution networks in Vietnam. They are known for high-reliability medium-sized modular towers used in light industry and commercial buildings, focusing on durability and efficiency.

Global leaders such as Baltimore Aircoil Company (BAC), SPX, and EVAPCO participate in Vietnam’s large-scale projects through local partners and EPC contractors. Their advanced closed-circuit and hybrid towers serve data centers, power plants, and high-end industrial processes. Products and services are available via certified distributors.

Vietnam’s market also includes many small-scale FRP and metal-structure cooling tower producers. They cater to SMEs, agricultural applications, and temporary setups. While price and delivery time are competitive, buyers should carefully assess long-term reliability and quality assurance.

Suppliers of fill media, fans, motors, and other key components—both domestic and imported—play an essential role in tower performance and lifespan. When sourcing, it’s crucial to verify component brands and warranty conditions.

In many large projects, clients purchase a complete cooling system, not just a tower. Therefore, Vietnam’s large M&E contractors and professional maintenance teams are key players, handling full-system delivery for industrial facilities, power plants, and data centers.

Due to regional differences in water hardness and salinity between northern and southern Vietnam, anti-scaling and easy-to-clean designs are crucial. Towers with closed-circuit or hybrid configurations and integrated water treatment systems can significantly reduce downtime and operating costs.

Given the varied transport and installation conditions across Vietnam, suppliers with local manufacturing and experienced installation teams have a major advantage. Companies like Alpha and TTP offer faster logistics and project commissioning.

The choice of fill material (PVC vs. wood vs. composite), fan efficiency, and motor grade directly impacts cooling efficiency and energy consumption. Procurement contracts should clearly list component brands and warranty periods.

For critical industries—such as food processing, pharmaceuticals, or data centers—vendors with proven references in similar sectors and third-party performance certifications should be prioritized. Vietnam’s market provides both experienced local contractors and technically advanced international suppliers.

Driven by environmental regulations and rising water costs, eco-friendly and hybrid cooling systems are becoming mainstream. Manufacturers increasingly emphasize sustainable design and high-efficiency fill technology.

Vietnam’s emergence as a regional data center and manufacturing hub has generated new demand for stable, low-vibration, and low-temperature-difference cooling systems. This trend favors both high-end local producers and global OEMs.

Long-term costs in cooling systems often stem from maintenance—fill replacement, fan upkeep, and water treatment. Suppliers offering comprehensive service packages and monitoring systems are gaining stronger market positions.

Vietnam’s cooling tower market features a dual structure:

Local manufacturers (e.g., Alpha, TTP, Liang Chi Vietnam) dominate mid-scale industrial and domestic projects through cost efficiency and localized service.

International brands (e.g., BAC, SPX, EVAPCO) lead in high-end sectors such as power generation and data centers, bringing advanced hybrid and closed-circuit designs.

When selecting a supplier, buyers should look beyond initial cost and consider water adaptability, component quality, installation capability, and long-term maintenance support.

For project-specific guidance—such as plant sizing, data center cooling solutions, or vendor comparison—I can further expand this overview into a procurement matrix or bid-preparation document.

Alpha Cooling Tower — Official website and project portfolio.

Vietnam Cooling Tower and Supplier Directories (Yellow Pages, Industrial Listings).

Thuận Tiến Phát (TTP) — Company introduction and product showcase.

HVAC and cooling system comparison reports for chiller–tower combinations.

Would you like me to format this English version into a print-ready PDF or a company comparison table (Excel) with contact info, capacity range, and key projects? I can prepare it in either format depending on your use case (marketing, sourcing, or report presentation).